Loading...

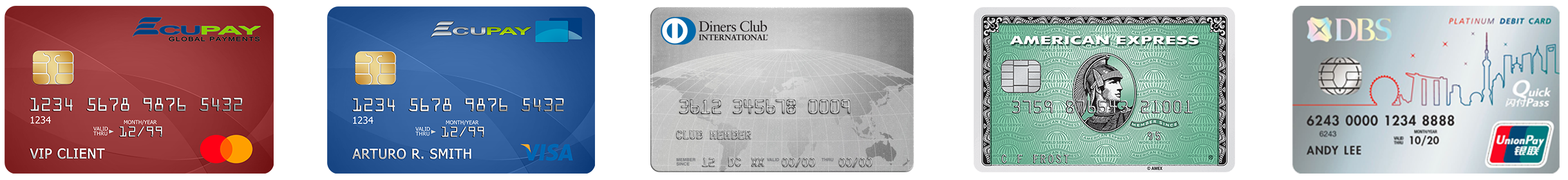

We process the main card brands for the United States and Latin America*, with a unique, easy-to-use suite of products and services that provide financial institutions and stores with processing solutions and tools for mitigation and evaluation of risk and fraud fields. Our instant approach helps Companies manage all their processing, while preventing e-commerce fraud and data security attacks.

We currently provide a credit card processing platform, also expanding into the world of remittances with value-added services to make our product much more attractive than other remittance services today.

The best service with the greatest stability, security and tools to provide the best payment method solution.

The best rates on the market with a personalized service for you.

Complying with the latest transaction processing standards.

Encryption system to guarantee secure communication.

24/7/365 automated monitoring system with online notification.

™ChargeBack Alert active 24/7/365 to minimize disputes.

With a set of tips and ready-to-use example code.

Prime Processing has a solid and proven Credit Card collection platform for many years with very large Customers performing millions of transactions both in the United States and globally.

Investment in financial technology worldwide continues to increase at an astonishing rate and that investment provides us with incredible advances in financial services. Prime Processing Group is dedicated to monitoring technological advancements related to financial services around the world and works tirelessly to develop and deliver world-class solutions to our clients.

Prime Processing Group offers creative, affordable, and world-class systems integration solutions with banks, network systems, and processors in the United States, Canada, Latin America, Central America, Asia, and Europe. Some of the world's most recognized brands are expanding their success with our services based on a fully integrated environment with a complete suite of services.

Our mission is simple: Significantly improve payment processing and minimize the damage caused by cybercrime. We are very excited to be able to offer your Company our advanced payment and security solutions. We offer a suite of products designed to help stores accept every possible payment type.

With Prime Processing's proprietary technology, selling online is no longer a titan task, since you do not need a large development budget or a large infrastructure to manage the processes, much less invest in hundreds of hours of programming to complete the project. payment button or shopping cart.

Prevent fraud with the FRsk First™ Risk Management service; Designed to ensure an optimal degree of protection, each transaction can be filtered through detection rules to find possible risks. The system is fully customizable and parameterizable & utilizes AES & SSL/TSL encryption protocols.

We have accumulated hundreds of successful consulting transactions in our long history. You will have access to useful information for developers to acquire and implement the right solutions for your specific needs. Enhance your payment management systems with one or more of our services and integration methods, adding more functionality to your system.

Once you sign up, you will have all the benefits of security and fraud protection for secure storage of stored profiles and much more.

"Having the information at hand on how to solve common situations makes your life more productive".

There will always be doubts or questions in the use of new systems, for this we put at your disposal the main FAQs in relation to our business model and the way we operate, we hope it makes your life easier.

There are hundreds (if not thousands) of options in payment processors. And, there are a lot of ways to accept card payments. But, be advised—all merchant processing services aren’t created equal. Here are some factors to consider when you’re selecting a processor:

Since there will always be some degree of risk associated with handling and transmitting sensitive data, processing credit cards with a reputable payment processor is vital. Above and beyond securing your computers, terminals and networks, there are a number of additional security measures you can implement to boost your security. A reputable payment processor can discuss your options in detail.

Most types of merchant businesses can qualify for a merchant account. The application process may vary depending on your business type and the associated risk that has been assigned by the credit card networks.

The cost of accepting credit cards varies widely. When you sign the contract with your payment processor, make sure you pay attention to how and what fees will be assessed. You’ll likely be responsible for interchange fees assessed by the card networks, various processing fees, and other additional fees depending on the services offered. Make sure you understand the fees you’ll be assessed before you sign your contract. And ask questions. You may be able to negotiable a lower rate.